are funeral expenses tax deductible in australia

Funeral expenses are also deductible if the funeral service is. Review the full list of non-deductible expenses by reading the IRS.

Which Statement Is Incorrect About Funeral Expenses Allowed Taxation Estate Tax Course Hero

According to Internal Revenue Service guidelines funeral expenses are not deductible on any.

. What is a funeral expense. The amount of these exemptions can vary. Some estates may be able to deduct funeral expenses.

Tax-deductible funeral expenses. Burial expenses such as the cost of a casket and the purchase of a cemetery grave plot or a columbarium niche for cremated ashes can be deducted as well as headstone or grave. Check your options to get the best value for money.

While the IRS allows deductions for medical expenses funeral costs are not included. While the IRS allows deductions for medical expenses funeral. Check that all tax obligations are complete before the final distribution of the deceased estate.

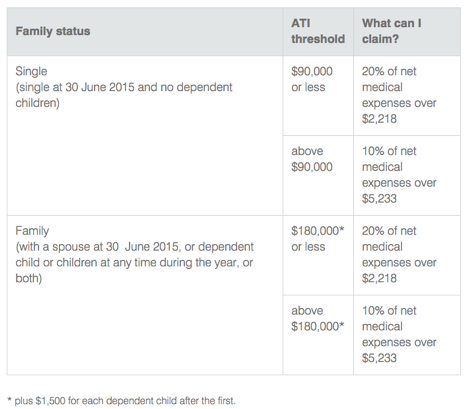

If you are eligible to deduct funeral expenses on your estates tax returns be aware that not all funeral expenses are tax-deductible. If you are a beneficiary of a deceased estate. What you can claim.

Individual taxpayers cannot deduct funeral expenses on their tax return. Ineligible expenses include venue hire or catering for a wake and headstonememorial costs. In arriving at the taxable value of the estate the following deductions from the gross estate are allowable.

These include the cost of a funeral burial cremation and other related items. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds. Confirming tax obligations are complete.

Unfortunately funeral expenses are not tax-deductible for individual taxpayersThis means that you cannot deduct the cost of a funeral. IRS rules dictate that all estates worth. If you want to protect your family from your funeral costs there are ways to pay in advance.

If youre considering whether funeral expenses are tax deductible here are some things to keep in mind. First and foremost any financial assistance you provide to the bereaved should be. It was 117 million in 2021 1206 million in 2022 at the federal level while its only 1 million in Oregon.

What funeral expenses are deductible. Are funeral expenses deductible for tax purposes. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. Funeral expenses are deductible according to the laws of your state. Estates try to claim.

What makes burial expenses tax-deductible. Are Funeral Expenses Tax Deductible. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

You can claim a tax deduction for most expenses from carrying on your business as long as they are directly related to earning your assessable income. However only estates worth over 1206 million are eligible for these tax. Funeral expenses can be deductible for some estates that used the estates funds to pay for the funeral expenses.

Debts of the deceased due at the date of death and funeral expenses. Individual taxpayers cannot deduct funeral expenses on their tax return. Funeral expenses are costs related to the death of a person.

10 Tax Deductible Funeral Service Costs

Are Funeral And Cremation Expenses Tax Deductible National Cremation

Are Funeral Expenses Tax Deductible

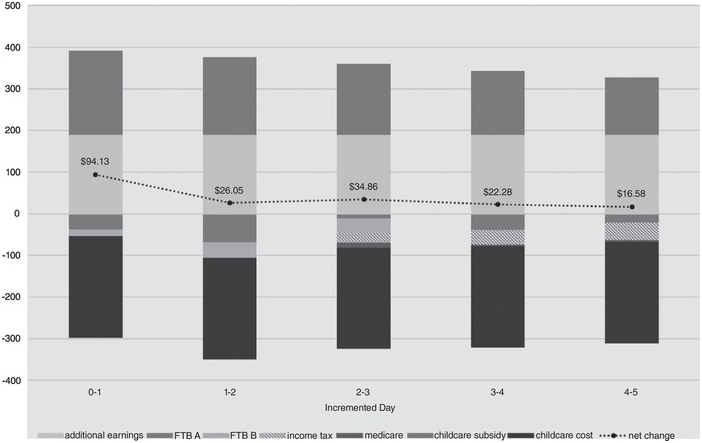

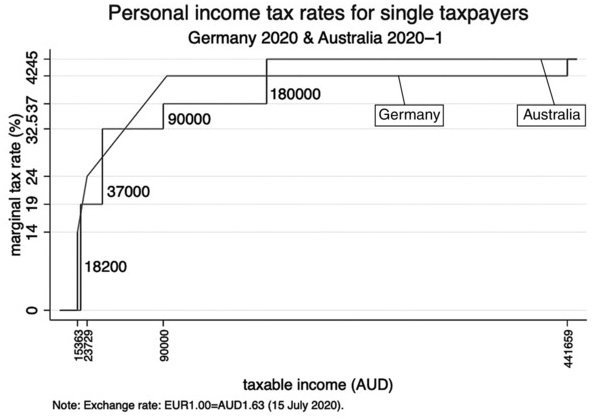

Tax Law In Context Part Ii Tax And Government In The 21st Century

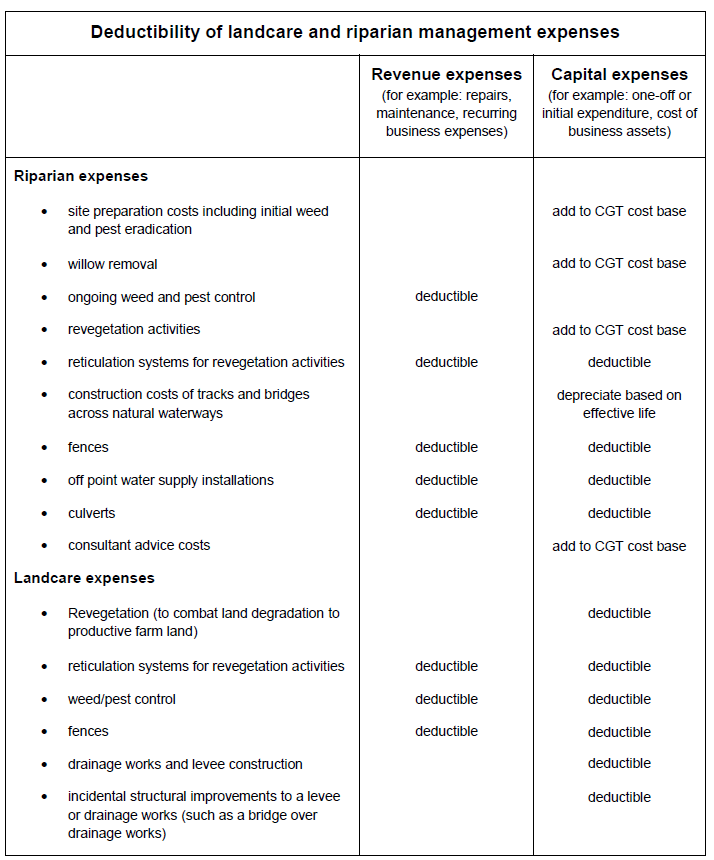

Tax Deduction Landcare And Similar Expenses Farm Table

Blog Upchurch Medicare Insurance

Tax Law In Context Part Ii Tax And Government In The 21st Century

Are Funeral Expenses Tax Deductible Youtube

What Is Workers Compensation Article

Simple Tax Guide For Americans In Mexico

Can Oz Relatives Attending Funeral Be Paid For By Estate This Is Money

Getting Organized Resources Peacefully

How To File Your Taxes If Your Partner Passed Away Zdnet

Tax Preparation Checklist For Australian Small Businesses

Local Law No 10 Of 2011 Approval Local Law To Amend Chapter 220 Of The Code Of Putnam County To Include Article Ii Sales Tax As Adopted By The County By Resolution